Who’s the biggest music publisher in the world?

Exposed Vocals offers our take on some of the music biz’s biggest recent goings-on. This time, after our analysis of the biggest record companies in the world, we turn our attention to the music publishing houses at Universal, Sony and Warner.

For the first time in recent memory, the global market power of the three major music publishers can be accurately compared.

Here’s why: in mid-November last year, Sony Corp completed the buyout of EMI Music Publishing (EMP) via two massive transactions.

The Japanese corporation, parent of Sony/ATV, acquired 60% of EMP from a consortium led by Mubadala (pricetag: $2.3bn) and a further 10% from the Jackson Estate (pricetag: $288m).

As a result, Sony, which already owned the other 30% of EMP, could, for the first time, include EMP’s revenues in its quarterly fiscal results – meaning that the corporation’s reported ‘music publishing’ sales now count Sony/ATV, EMP and Sony’s music publishing interests in Japan.

What does all that waffle mean? It means we can do something new: stack the three major owned publishing groups (Warner Chappell Music, Universal Music Publishing Group and Sony’s music publishing interests) alongside one another to see who dominates, revenue-wise, on a global scale.

The results probably won’t shock you..

Before we get to the goods, some explanation of our methodology: Warner Music Group (parent of Warner Chappell Music) reports its fiscal results in dollars, what with being based in the United States.

To get a fair comparison of revenues, EV has, below, translated the reported quarterly Yen results of Sony Corp (Japan) and the Euro results of Universal/Vivendi (Paris) into US dollars – converted at the prevailing quarterly rate given by both companies. From this, we have then highlighted each firm’s USD-level global publishing revenues in calendar Q1, Q2 and Q3 2019.

(We have also done the same for calendar Q4 last year, although this disadvantages Sony’s publishing division; Q4 runs October through December, and the EMP acquisition was not completed until November 14 2018.)

As you can see above, with EMP within its ranks, Sony now comfortably owns the world’s biggest music publisher (though, in calendar Q3, perhaps by a lesser margin than you might expect).

In the three months to end of September (Q3 2019), according to MBW’s calculations, Sony’s publishing companies (including Sony/ATV and EMP) generated $357.6m; Universal Music Publishing Group, meanwhile, was $30m behind on $327.5m.

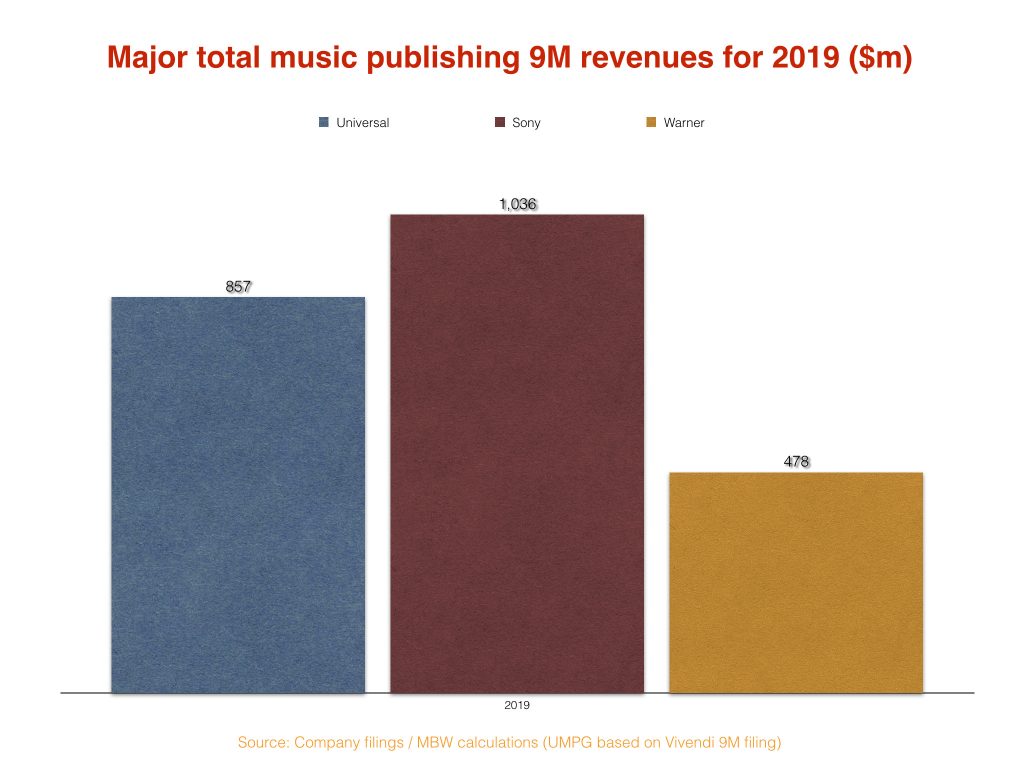

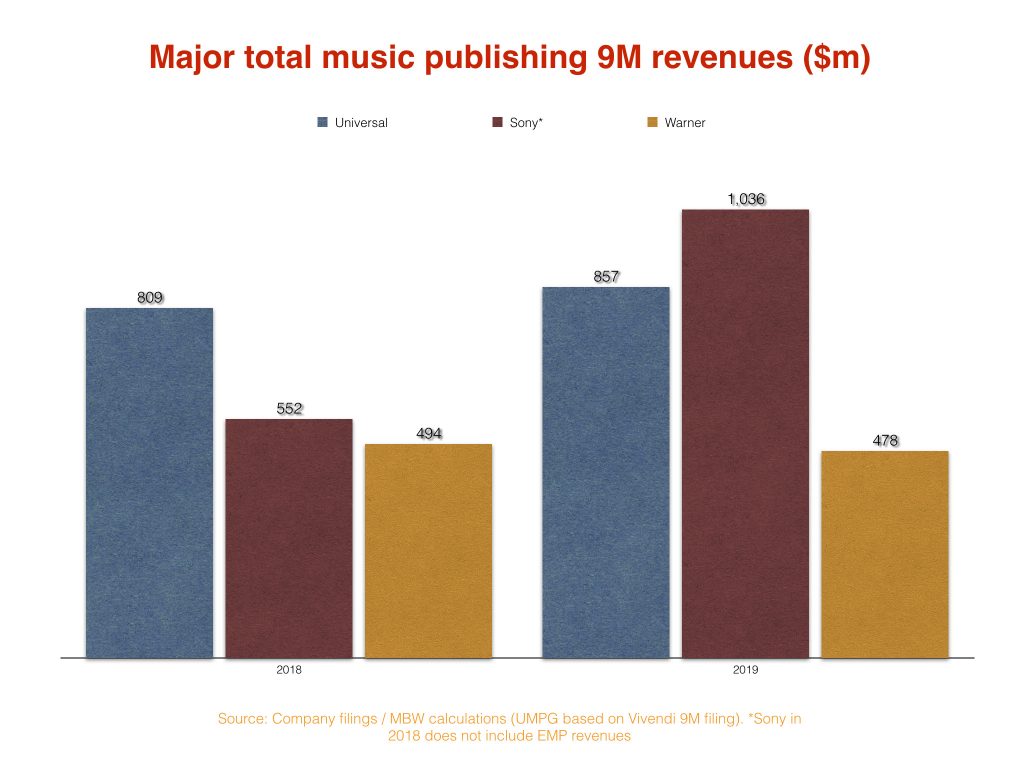

How does all of this look when you glance across the first three calendar quarters of 2019 (i.e. the first nine-month period where EMP has been fully owned by Sony Corp, and therefore reflected in its revenues)?

Here goes:

There you have it: Sony’s publishing companies surpassed a billion dollars in revenues in the nine months to end of September 2019.

In doing so, the company was comfortably bigger than UMPG, which put up a spirited fight in the period, and should once again surpass a billion-dollar revenue haul in 2019.

Looking at the average quarterly performance of Universal, Sony and Warner in 2019 so far, we can confidently forecast that Sony’s annual (calendar) publishing revenues in 2019 will end up somewhere around $1.4bn, UMPG’s will weigh in at around $1.15bn and Warner Chappell will post around $650m.

Warner Chappell Music is therefore now less than half the size of Sony’s publishing operation, according to our calculations.

WCM revenues fell slightly in the first nine months of 2019 vs. the same period of 2018 – as they did in Warner’s own latest fiscal FY results, covering the 12 months to end of September. (WMG noted in its FY results that unfavorable currency fluctuations had led to a year-on-year reduction, rather than a very slight gain, in WC revenues. That said, in the USD-converted model represented above, all three companies’ 9M revenues are subject to the same exchange rate movements.)

Universal’s nine-month publishing revenues (to end of Sept) grew by $48m year-on-year in 2019.

Sony’s reported equivalent number almost doubled, largely owing to the effect of EMP revenues only being counted in Sony Corp’s reported results from calendar Q4 ’18 onwards.

(For this same reason, Sony’s reported nine-month publishing number for 2018 – $552m – is misleadingly small and should be dismissed for those wanting to ascertain last year’s performance of Sony/ATV. The latter company administered EMP’s catalog in the Jan-Sept 2018 period, but EMP’s full revenues were not reflected in Sony Corp’s associated published accounts.)

Sony, then, is obviously the dominant party amongst the majors when it comes to the global music publishing picture – but, as we know from our analysis last week, Universal is kingpin when it comes to worldwide recorded music performance.

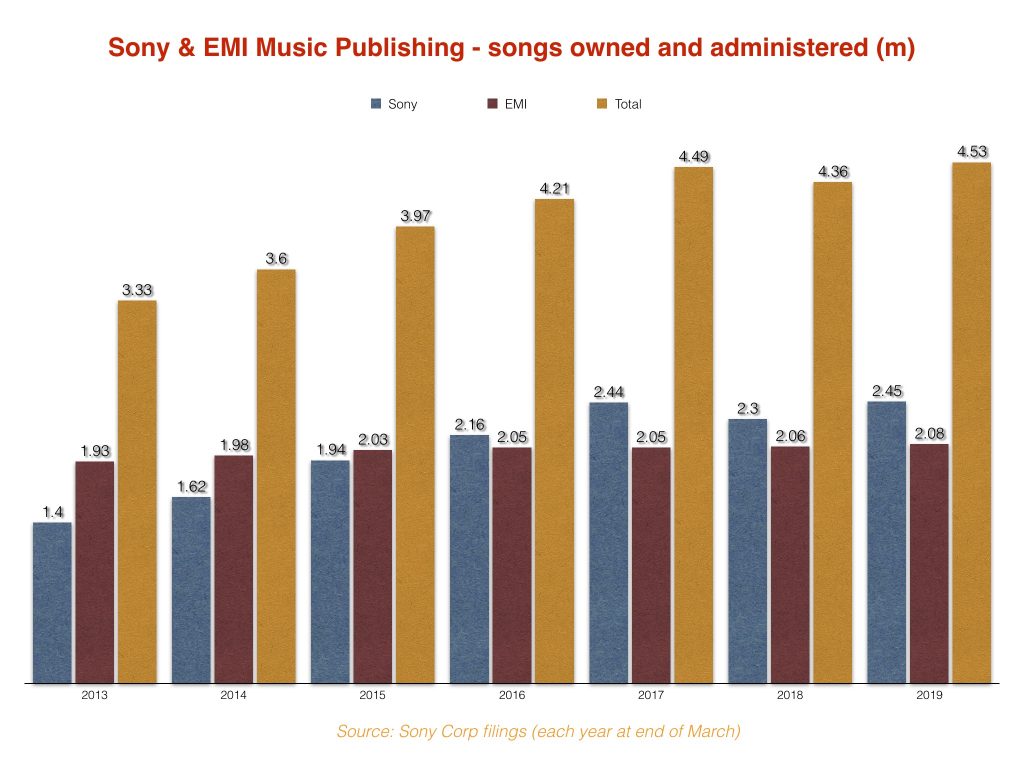

Speaking of Sony’s dominance of music publishing, check this out:

The above chart, based on Sony Corp filings, shows the number of individual songs ‘owned and administered’ by Sony and EMI (and both parties combined) at the end of March each year.

It demonstrates that, in the six years from March 2013 to March 2019, Sony has grown the net number of songs under its control by more than a million compositions.

Sony’s rivals may begrudge the firm’s financial supremacy in the music publishing market today, but no-one can shout down the company’s commitment to its field.